Travel disruptions remain top-of-mind for many travelers, especially those with families. Booking that long-deferred vacation only to have it fall apart is a real concern. So insuring a trip against inevitable uncertainties can save families from travel losses — if done right.

International travel is roaring back. Per the International Trade Administration, the number of U.S. citizens leaving for international destinations in April 2022 was nearly 2.5 times higher than the year before. Yet traveling abroad still carries risk of travel disruption.

According to an August 2021 AAA survey, 31% of U.S. travelers say they are more likely to purchase travel insurance for trips through the end of 2022 because of the ongoing COVID-19 pandemic.

But what are the best ways to buy travel insurance for a family? And, for starters, what is travel insurance, exactly?

Travel insurance 101

Travel insurance is a confusing term because it sounds like a single thing. In reality, travel insurance providers offer a buffet of insurance options that can apply to your travels. So asking a question such as, “Does travel insurance cover trip cancellations?” is like asking whether home insurance covers earthquakes — some types of coverage do, and some don’t.

The most common types of travel insurance coverage include:

-

Emergency evacuation and repatriation.

-

Trip cancellation and delay.

-

“Cancel For Any Reason.”

Like car insurance, most travel insurance plans will cover multiple common issues, and you can choose the specific benefits for your trip. Your selections will affect the overall cost.

One of the more common misconceptions about travel insurance is that it will cover all changes and cancellations. Many travelers learned the truth the hard way when the pandemic began, and the cost of their scuttled plans was not reimbursed by their travel insurance policies. Travel insurance is an umbrella term, and only certain types of plans cover changes and cancellations caused by unforeseen events.

Yet coverage for changes and cancellations is what many traveling families are looking for. Squaremouth, a travel insurance comparison tool and NerdWallet partner, reports that 42% of its customers in April 2022 were seeking coverage specifically related to contracting COVID-19.

Here’s the gist: If you’re looking for travel insurance that covers changes caused by COVID-19 illness and border closure, search for providers that offer it specifically. It’s not always wise to accept the insurance plan offered during checkout when you purchase travel through an airline or hotel site.

Does travel insurance cover family members?

Sure, you might get reimbursed for your trip if you come down with COVID-19 the day before you’re set to leave. But what if your toddler does?

For the most part, travel insurance coverage will offer the option to include family members. Some plans will include children 17 and younger automatically when they’re traveling with a parent. Others will require that you add each family member individually to the plan.

This is an important distinction, especially when comparing costs between different travel insurance policies.

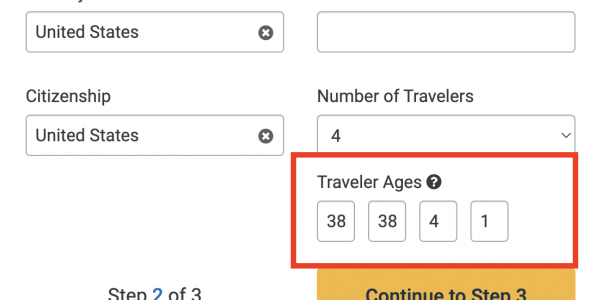

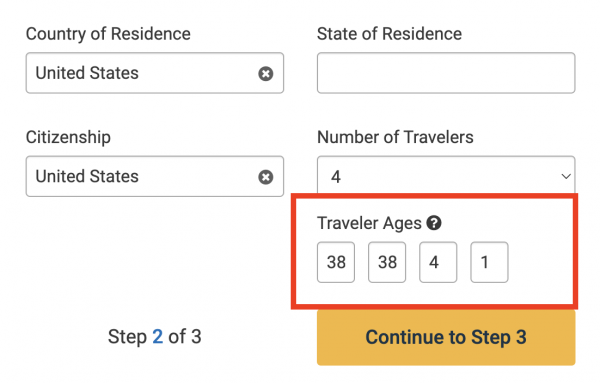

Using a comparison tool can help, especially if you don’t love wading through the fine print. You can enter your family members’ ages and the tool will automatically factor those into its price comparisons.

An insurance comparison tool like Squaremouth (a NerdWallet partner) can help you find a sufficient policy. (Screenshot courtesy of Sam Kemmis)

Of course, you can always double-check the terms and conditions to make sure each family member is covered adequately. But using a comparison tool in this way can save a big hassle.

Consider other flexible options

The pandemic has shifted the world of travel insurance to focus more on flexibility. But it’s had the same effect throughout the travel world.

Airlines and hotels now generally offer more flexible booking options. With the notable exception of basic economy airfares, which generally can’t be changed or canceled, airline tickets are now far more flexible than they were two years ago.

It’s also the case that several premium credit cards include travel insurance as a built-in benefit for any bookings made with those cards (though coverage policies vary).

What does this mean for traveling families? It might make sense to make flexible bookings rather than buy family travel insurance that covers changes and cancellations. The other benefits of travel insurance, such as medical coverage, might still be a smart move. But make sure you’re not getting cancellation coverage for a trip that is already extremely flexible.

The bottom line

Traveling with an entire family can be a major expense. And like any expense, it can be wise to insure it.

Most travel insurance policies will cover families, either automatically or for an additional fee. The easiest way to compare plans is to use a travel insurance comparison tool, enter your family members and trip details, and choose the plan that makes sense for you.

Remember: Not all plans cover the same thing. If you’re worried about cancellations caused by COVID-19, make sure to search for that coverage specifically. And consider other flexible booking options beyond insurance when making plans.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2022, including those best for: