FreshBooks is accounting software from the company of the same name, designed for small businesses as well as individuals, and with customers in more than 100 countries.

FreshBooks accounting softwareFreshBooks offers accounting, invoice and payments solutions for small businesses. on FreshBooks’ site. |

The application has helped more than 20 million people process billions of dollars through its invoicing, time-tracking, expense management and online payments features.

Here are five things to know about the software that might help in the decision-making process.

1. What does FreshBooks cost?

FreshBooks is available through four standard pricing plans, each offered on a monthly or yearly basis. Note that the company often runs online discounts for new customers.

-

Lite, designed for self-employed professionals and priced at $15 per month or $148.50 annually. It covers five billable clients.

-

Plus, aimed at small businesses and priced at $25 per month or $247.50 annually. It covers 50 billable clients.

-

Premium, designed for growing businesses and priced at $50 per month or $495 annually. The plan covers 500 billable clients.

-

Select, designed for businesses that need dedicated support. It has custom pricing for both the monthly and yearly options. It supports more than 500 billable clients.

2. What features does FreshBooks include?

Among the features included with specific pricing plans are:

Lite

-

Unlimited and customized invoices.

-

Unlimited expense entries.

-

Acceptance of credit card payments and ACH bank transfers online.

-

Automated bank import.

-

Unlimited time tracking.

-

Tax reports.

-

Mobile mileage tracking.

-

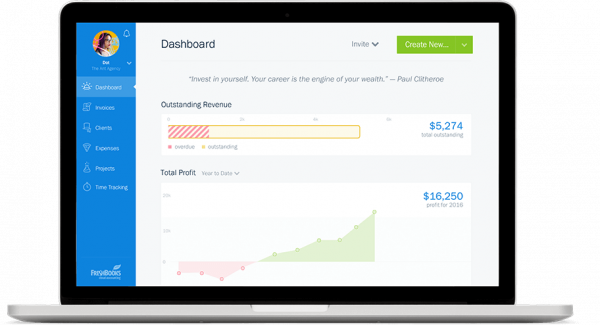

Dashboards that allow users to keep records of activity and share reporting with clients.

-

Business health reports.

Plus

All of the above, plus:

-

Unlimited proposals.

-

Automated recurring invoices.

-

Double-entry accounting reports.

-

Scheduled late fees.

-

Automated late payment reminders.

-

Client retainers.

Premium

All of the above, plus:

-

Team members.

-

Advanced payments.

Select

All of the above, plus:

-

Personal account manager.

-

Customized training.

-

Low credit card transaction rates.

-

QuickBooks and Xero integration.

3. What security features does FreshBooks have?

The accounting software offers a number of security features and capabilities. These include 256-bit secure sockets layer, or SSL, encryption, which protects all information traveling between a user’s browser and FreshBooks; firewalls; and regular vulnerability scanning of FreshBooks’ servers, conducted by a managed security provider.

FreshBooks also features industry-standard encryption protocols and practices to protect the transmission of sensitive information and notifies authorities if there’s a security breach of the main payment card.

4. What customer support options are available?

The company offers email and phone support for its software. Emails are normally answered within 60 to 90 minutes, and phone calls are answered within two rings by a customer support representative.

Customer support is available Monday through Friday from 8 a.m. to 8 p.m. Eastern Time. There is no charge for support. The company also offers a self-serve resource for customers on its website and includes guides on FreshBooks features.

5. Does FreshBooks offer solution add-ons?

To address the limited tax-estimate capabilities of the software, FreshBooks offers integration to applications such as Taxfyle, which provides users with an upfront quote for their personal or business taxes and then pairs them with a verified CPA or IRS-enrolled agent to prepare their taxes for them.

More about FreshBooks

Free trial available

FreshBooks offers a 30-day free trial for new users, designed to make it easy for business owners to get a feel for the platform so they can see if it’s right for them.

Related offerings

FreshBooks recently announced its acquisition of Facturama, a Mexican e-invoicing company that provides electronic invoice management, reporting and other organizational services to more than 19,000 self-employed professionals, small businesses and startups. Supported by FreshBooks, Facturama’s service will enable greater scaling capabilities in Mexico, where the small business market is growing.