The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Welcome to NerdWallet’s Smart Money podcast, where we usually answer your real-world money questions.

This week’s episode is dedicated to a chat with Paco de Leon, author and creative. Personal finance Nerd Kim Palmer talks with de Leon about her book, “Finance for the People,” plus how to take a more creative approach to budgeting, financial decision-making and building wealth. She says reflecting on how you are “weird about money” is a great place to start.

Check out this episode on any of these platforms:

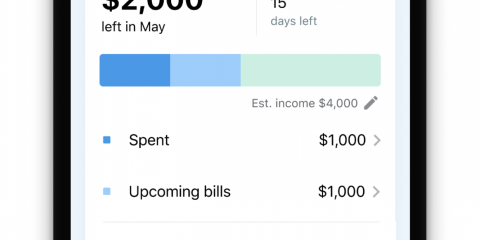

Before you build a budget

Track all your spending at a glance to understand your trends and spot opportunities to save money.

Our take

Being smart about money begins with embracing our own unique preferences and learning styles when it comes to finances. That might mean starting with small, manageable steps, such as setting aside time each week, or opening up a new savings account. For some people, it could mean taking a more visual approach instead of relying on numbers and spreadsheets alone.

If paying off debt is among your financial to-do’s, then it can help to write a letter to it as a way of confronting it — and your feelings around it — directly. From there, it might help to use an online calculator to choose your strategy for paying off that debt over time.

Building wealth, another popular goal, can start with reflecting on how to spend less and save more, which might include automating savings and making sure your money is growing over time. It can also include maximizing your earnings by making money in new and different ways.

The bottom line is that we all approach money differently, and choosing a money management strategy that matches our own personal preferences can help us stay engaged and on track.

Our tips

-

Embrace financial literacy: Regardless of where you’re starting from, there’s always more to learn when it comes to money. Choosing a method of learning about money that is fun and enjoyable, whether it’s reading books or listening to podcasts, will help keep you engaged.

-

Set aside time every week for your finances: Devoting half an hour to an hour every week to your finances can really pay off. You can use that time to review credit card statements, make a plan to pay off debt or open up a new savings account.

-

Build assets to build wealth: Try automating your savings and reviewing those savings regularly to make sure they’re working for you.

More about learning how to manage your money and build wealth on NerdWallet:

Episode transcript

Sean Pyles: Welcome to the NerdWallet Smart Money Podcast, where we typically answer your personal finance questions and help you feel a little smarter about what you do with your money. I’m Sean Pyles. We have a special episode in store for you today. Regular Smart Money guest and personal finance Nerd Kim Palmer is kicking off the second episode in our Book Club series, where she talks with authors of personal finance books about their advice for how you can manage your money. So, Kim, who are you talking with this episode?

Kim Palmer: I am speaking with Paco de Leon, author of “Finance for the People,” a new personal finance book aimed at creative people who don’t necessarily relate to traditional money advice. Paco is also an illustrator and a musician, and runs a financial education firm and bookkeeping agency, and she has a lot of great insight for us.

Sean Pyles: Sounds great. Well, I will let you take things from here.

Kim Palmer: Thank you. Paco, welcome to Smart Money.

Paco de Leon: Thank you so much for having me. I’m excited to be here.

Kim Palmer: You talk in the book about how money is power and how a lot of people feel, “ignored, unserved and underserved by the personal finance industry.” That was something that really struck me. Did you start working with and writing about money because you wanted to change that?

Paco de Leon: Yeah. I mean, I wanted to know actually how I could help my community, which are creative people. I’ve been playing music, playing in bands since I was 15, and once you break into this band community, you start to meet other musicians. When you meet a bunch of other musicians, you start to meet painters and ceramicists and the guy who studied drums in college.

The more I went to work in the daytime and learned about bonds and duration and returns, and the more I hung out with my artist friends, the more I just started to see this gap in just this community just was ignored and not served. I was very curious if I could create something — a business, a book, anything — that could help fill that gap and to speak to that audience, and if I could keep a roof over my head and feed myself in the process.

Kim Palmer: Well, we’ll definitely get more into that. One of my favorite lines in your book is, “We are all weird about money and we must first address how and why we are weird.” Can you explain that more? I mean, how would you say you are weird about money?

Paco: Oh, my God, I’m really weird about money in a lot of different ways. I think everybody’s weirdness is their own unique cocktail, and when I say weirdness, I mean, we all have these hangups or narratives or beliefs and cognitive biases about how we think money works in the world, and that determines what we think we’re able to do.

From a work perspective or from an investing perspective, I don’t believe that if we figure out our cognitive biases and change them, that that’s going to be the only thing that matters in the world. Of course, there’s inequality, there’s racism, there’s things that are outside of our control. But facing our weirdness is one way that we can find our agency in a world that just is gnarly and nuts and rapidly changing and very volatile.

Addressing your weirdness also helps you figure out how you can make better decisions because instead of being driven by your emotions or being caught up in a trap of stress, we can try to use our cognition as much as possible.

Kim Palmer: And it sounds like you’re saying, too, that that weirdness, that uniqueness, that can be a source of strength.

Paco de Leon: I definitely think so. I’m optimistic to a fault, but as a creative person myself, I understand that creativity sometimes comes from a source of pain, and that transformation and the way that you can change your life and create things that are meaningful or helpful to people, that oftentimes comes from your own struggle. “Finance for the People,” I don’t think I would’ve written it had I not also struggled with finances myself.

Kim Palmer: You also — you recommend actually putting aside a half an hour to an hour every single week to work on your finances. Can you explain what are some of the things we should be doing during that time?

Paco de Leon: Yes. I will not stop talking about weekly finance time as my very first recommendation for folks who are especially afraid to face their finances, or they haven’t done it and they know they need to do it. I think if you block off some time on your calendar every week and have it as kind of a therapy appointment — but instead of going to see your therapist, you’re going to see your money, and it’s you managing all these things and learning how you spend and all that fun stuff.

But I think when you’re first starting out, the very first thing you can do is just get all your logins. Find a password manager and make sure you are able to log in. And maybe the next week, you just look at your transactions and start to just run your eyeballs over what you’ve done in the past. I think those two things alone are going to be insightful and going to take away a lot of the hurdles that some people are facing.

If you’re like Jedi expert level with your finances, I still think you can benefit from weekly finance time. You can look at your money, you can project a cash flow and strategize what you want the next couple years to look like, or even try to pin down that very, very elusive thing called retirement.

Kim Palmer: It sounds like part of this is just getting organized.

Paco de Leon: It’s definitely getting organized, but it’s also falling in love with the process. That’s one of the themes of the book is, American culture is a very goal-oriented culture, and I think that’s been wonderful and it does help people accomplish things. But at the end of the day, whether you’re a writer, whether you’re a painter, whether you’re somebody who wants to amass a million dollars — or however much money you want to amass — the reaching of the goal is the fraction of the percent of the time, right?

When you reach the goal, it’s this fleeting feeling. It’s this moment that just passes, and how do you get there? You get there by showing up every day and following a process and being in love with the process. I can’t emphasize that enough. Managing your finances, learning all about it, facing yourself and what you want out of your life — that’s just a process that you can show up for every week.

Kim Palmer: Well, speaking of falling in love with the process, I really like your approach to making a spending plan. You talk about putting your expenses into three categories. Your labels for them, as examples, are bills and life for those essentials; fun and BS for non-essentials; and future and goals for what you’re saving for. You say this approach, it can also help if we’re managing money with a partner. Can you explain that and how this approach offers some level of flexibility, too?

Paco de Leon: Yeah. I think this approach is really great for feeling autonomous in a relationship, but also feeling like you’re working together to achieve something. Other finance writers might call this method, mine, yours and ours.

The way that it would work with somebody who you’re managing your joint finances with, your partner, is both parties would figure out what they need to contribute to the bills and life account. They can pay joint expenses out of that account, like rent and groceries and renter’s insurance, things like that. Then each person would have their fun and BS account, which is it’s kind of a dirty word, but it’s their allowance, right? Whatever you have in your allowance account, your fun and BS account, you just do whatever you want with it because it’s your money and you get to choose how you want to spend it.

I think this is a really healthy way for couples to approach finances because you don’t have to have all these little conversations about, like my wife and I, we don’t have to have a conversation about some weird face steamer that she wants to buy for a hundred dollars, and I don’t have to have a conversation with her about the fact that I want to hoard my allowance and then dump it into some coin, some crypto, because I’m curious about it. Or, if I wanted to buy a guitar.

It’s a way to eliminate some of the friction, and it allows us to have autonomy when it comes to spending our money in ways that we want to spend it. But we’re also already accounting for all of our obligations with bills and life, and we’re also thinking about the future, right? We’re also allocating money to our future and goals.

Kim Palmer: I love that approach, and I feel like it also allows for a judgment-free zone if you’re saying you don’t have to justify everything or ask permission.

Paco de Leon: Totally, and you don’t have to have these tedious conversations, right?

Kim Palmer: Exactly. Well, let’s talk about overspending too, because a lot of people struggle with that. You write, I love this, “Paco’s Law says that your spending will equal what you have to spend,” and I definitely relate to that. How do we counteract that?

Paco de Leon: Again, having the fun and BS account is a way to create a limit to what you’re allowed to spend. If you have X amount of bucks in your fun and BS account, that’s it. That’s how much you have to spend for the month on all the nonsense, all the beer, all the hobbies, all the vices, all that discretionary stuff.

Kim Palmer: You also — you have a really helpful visual approach, too, when you’re trying to make some of the bigger financial decisions we have to figure out. The examples you give are, should I go back to school or should I quit my job? Which are really big, hard questions that people have to grapple with.

In one of the illustrations in your book — and I should say you have a lot of illustrations that are really helpful throughout the book — you created a rainbow with what looks like sad and anxious looking clouds, and it’s labeled, “A chill the beep out menu to help me get into my window of tolerance.”

You give some examples, and basically, I think what you’re saying is this is a way to help you sit with these hard financial decisions and maybe come to an answer that’s right for you. Can you explain that?

Paco de Leon: Yeah. The window of tolerance is this way of understanding where you’re at, where your nervous system is at. The window of tolerance basically states that we all have this optimal zone, which is called the window of tolerance, where we are able to deal with life’s ups and downs, right? We’re able to deal with stress in a way that’s healthy.

When you’re outside of the window, you’re either hyper aroused or you’re hypo aroused, and on one end of the spectrum, you are numbed out. You’re paralyzed. You’re frozen. You can’t react. That, from a financial perspective, those behaviors look like never looking at your finances, just ignoring it, not opening your mail. The other side of that spectrum is feeling anxious, being on edge, trying to do a bunch of things all at once and never being focused, being frantic.

The idea of knowing about the window of tolerance is understanding that sometimes we’re going to get pushed out of it, and we have to understand where we lie on the spectrum, where we’re being pushed. Are we numbing out or are we freaking out? Then we have to know ourselves. We have to realize, OK, what’s going to bring back into this optimal zone where I can just deal with stress in a healthy way?

Depending on where you land, for some people, splashing cold water on your face, jumping up and down, going for a walk, listening to Lizzo very, very loudly, which helps me. For other people, they might need to take some essential oils and rub it between their hands and smell it, or take five deep breaths, or hug their dog. Different people will need different things to bring them to this calm state where their nervous system is not freaking out and forcing them to make financial decisions from a purely emotional perspective.

That’s really the reason why I wanted to educate people about their window of tolerance. I also genuinely think if we know about our window of tolerance, we will be better human beings on planet Earth to one another. We’re not going to be freaking out. Or, if we are freaking out because somebody didn’t turn on their turn signal or cut us off in traffic, we can self-soothe. We can collect our feelings. We can figure out a way to normalize and not be so activated, and then we can walk through life just being better to each other.

Kim Palmer: Yeah. I mean, what you’re saying makes me think, too, this advice applies even outside making big financial decisions, probably anytime you’re making a big life decision.

Paco de Leon: Exactly. Once you get used to going through the motions of this, especially with the really big financial decisions — like in my book, I mentioned my decision to not go to law school. Once you get good at knowing where you are, whether you’re outside of your window of tolerance or within it, it gets easier.

It’s like a muscle that you exercise. It gets stronger, and so it translates and you could be standing in the line at the grocery store and you can ask yourself, “Do I really need to buy something that’s sitting in the impulse section? Or, am I outside of my window of tolerance? Can I take a deep breath as I’m standing in line right now, and will that regulate me and then allow me to make a better decision?”

I know that sounds silly — a few bucks here or there — but there’s a lot outside of our control. Decision-making is within our control, so if we can find how we can be the most effective decision-makers, it’s just one of the ways we can control our destiny, so to speak.

Kim Palmer: Let’s talk about debt, too, which is related to all of this. Of course, a lot of people struggle with debt. One thing you really emphasize to your readers is letting go of a sense of shame or a sense of failure. Can you tell us more about that?

Paco de Leon: Yeah. I think we’re really driven by shame and guilt and feeling badly. Particularly, I feel like we’re using that tool in society to get people to behave in a certain way. We’ll just shame people, and I’m not down with it. It’s super weird to use shame and guilt to try to get people to behave a certain way, one. I think that there’s a lot of morality. That it’s tied up into this idea of paying one’s debts, right? I just wanted to offer people a different perspective on debt.

While I was doing debt research and trying to understand the origins of debt in our society, and within humanity, I realized that this concept of debt has been around before the concept of money even, or rather we have always had this idea of debt. If you even look at indigenous cultures that sacrificed animals to settle a debt with the gods, there’s always been this idea of debt.

Now in the modern world, we can apply that to our economics and our financial system. If we look back, I mean we can look at some of the religious origins where we have Protestantism and the Protestant work ethic, and how all of that is wrapped up in this idea of one must work hard, one must repay their debts. I think it’s important to take a step back and look at where these biases come from, where these narratives come from. Where are these stories about, if you don’t pay your debts, you’re a crappy person. Where does that come from?

If we can look at them, can we take away the power? Can we change the story? Can we change the narrative, both on an individual level and on a society-wide level? Because sure, one ought to pay one’s debt, but we have to also look at sometimes there are systems that are created where people are trapped in their own debt cycle and it’s not entirely their fault, and I think it’s important to highlight that.

Kim Palmer: One related technique that you write about, which I had never heard before, but am so fascinated by, is this concept that you can write a letter to your own debt and confront it in that way. Can you explain that? I found that so striking.

Paco de Leon: Yeah. My friend, Melanie Lockert, is an author, a writer, entrepreneur. She wrote this book called, “Dear Debt.” Actually, she’s the reason why I was introduced to this concept, and what she did was — she was in a tremendous amount of student loan debt. She was feeling depressed and anxious and paralyzed, and one of the ways that she started to focus on her mental health and to try to cope with this was she wrote a letter to her debt.

I think it’s fascinating for us to write a letter to money or to debt to help us understand how we feel about it, where our stories about debt come from, where the underlying thread of shame and guilt come from. That can come out on the page because when you’re writing, you can have this stream of consciousness, like with journaling, and you can begin to see where you got those feelings and where you got those stories.

Once you name them, once you see them, now you can decide, “Well, is this true true, like really, really true, true, true? Or, is this something that I’ve picked up and now I’m running that story on loop in my head, and I just, I believe it?” You know what I mean?

Kim Palmer: It’s almost like personifying the debt, but in a way that gets at your true feelings.

Paco de Leon: Exactly, exactly. I think it maybe makes it less scary. It makes it less this nebulous cloud of crazy feeling inside of your body. You’re just able to organize your thoughts and feelings — just gets it out there, and I think that feels better. But it also allows you to realize, “OK, well, what can I do now that I’ve addressed my feelings, right? Now that I’ve seen how weird I am about money and about debt, OK, what can I do practically to move forward?”

Kim Palmer: Well, one chapter of your book is about wealth building, which is a very popular subject around here. You point out that in contrast to a lot of what we see in pop culture, wealth is really not about what we’re spending our money on, but it’s the money we keep, what we own. For people who are just getting started building their wealth, or trying to, can you describe your approach? I mean, what’s the easiest way to begin? How can we create valuable things for ourselves?

Paco de Leon: I think it’s important to understand the underlying mechanisms of what wealth is. Or, how one can generate wealth and then live off of said wealth. But I think before you understand that, it’s important to make the distinction between income and wealth, right? We think that people are wealthy because we see them spend money, and that’s not always the case.

What’s really popular in culture right now are these documentaries about scam artists who are spending money like they have it, but at the end of the day, they don’t. I think it’s important to be highlighting this and showing this story that oftentimes wealth is what you don’t see. Wealth is what you don’t spend because you’ve saved it, because you’ve invested it.

That’s a hard concept because it’s not really concrete. It’s a little bit abstract, but once I think you start to understand, OK, that’s what wealth is — what you keep and not what you spend — then you can find ways to start amassing wealth or creating assets or buying assets.

Here are the three secrets to building wealth. I’ll give it to you for free. Number one, be born wealthy. Though if you can’t, have figured that one out, if that’s not you, then you need to build assets or buy assets. Assets are basically anything that can be sold and turned into money, or anything that can generate a revenue stream.

Here are a couple of examples. A business can generate a revenue stream for you, or you could sell it, so that’s an asset. Or, you can buy shares of an index fund and you can sell it, and that will be turned into money. Or, you can live off of dividends, which is an income stream.

Kim Palmer: It’s interesting, too, what you’re saying about your observations — pop culture and reality shows — because I’m thinking that it would be probably really hard to make an interesting reality show about true wealth, about what people aren’t doing?

Paco de Leon: Kim, I beg to differ. I think we could do some funny, funny stuff. We could follow around the most frugal people and watch them eat beans all day long and just see the crazy measures they go to. It would be so entertaining to really watch a hardcore FIRE person — Financially Independent, Retire Early person — just to see the lengths that they’ll go to save that extra 10 bucks. You know? I think that would be really interesting.

Kim Palmer: OK. I want to see that show now. That does sound good. To me, one really big takeaway from your book is that if you feel like traditional money advice just isn’t really clicking for you, it’s OK. And you can still be good with money and you can take a more creative approach or just find the approach that works best for you. Can you leave our listeners with any final thoughts or final takeaways?

Paco de Leon: Absolutely. The industry is a weird industry. The financial services industry, they use jargon to intimidate you — they try to sell you stuff that you don’t understand. And with wealth management, they don’t say — like in a normal world when I sell you a tuna fish sandwich — I just say, “It’s $10.” And then you go, “OK, I see what I’m getting.” I get a sandwich for the money and I pay you.

With wealth management, they say weird things like, “We’re going to charge you 1% of all the money that we’re managing for you.” Then you have to do this weird math in your head to try to understand, first of all, what you’re being charged? And then they’re doing all this voodoo magic, right, of managing your money to make more money, which a lot of us don’t understand how that works. So, we don’t even know what we’re buying.

Just understand that the industry is weird in that sense, and it’s built for you to not really know what’s going on. It’s built to be opaque, and there are people in the world that are like NerdWallet, and all the folks over there and myself, that understand that it’s built weird like this, and we’re trying to just lift up the curtain and show you what’s going on.

Kim Palmer: Thank you so much. Thank you for being on our podcast.

Paco de Leon: Thank you so much for having me. This is my pleasure.

Kim Palmer: That is all we have for this episode. To share your thoughts on how to budget, pay off debt or manage finances, shoot us an email at [email protected] Also visit nerdwallet.com/podcast for more information on this episode, and remember to subscribe, rate and review us wherever you’re getting this podcast.

Here’s our brief disclaimer thoughtfully crafted by NerdWallet’s legal team. Your questions are answered by knowledgeable and talented finance writers, but we are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes. It may not apply to your specific circumstances. And with that said, until next time, turn to the Nerds.