Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a discussion about eggs — why they’re so expensive right now and how you can adjust your shopping habits.

Then we pivot to a discussion about the 2022 home improvement season.

Check out this episode on either of these platforms:

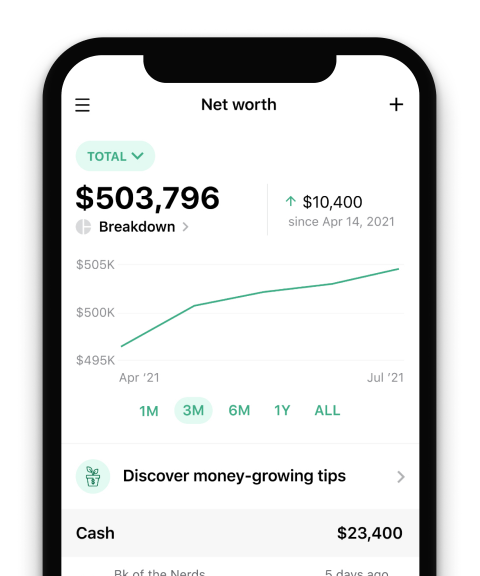

Track your money with NerdWallet

Skip the bank apps and see all your accounts in one place.

Our take

The disparate issues driving up egg prices are converging to scramble food budgets across the country. To start, the avian flu that’s spreading across the country has led to more than 20 million chickens being killed this year. That means there are fewer chickens laying eggs right now.

Gas prices have made getting eggs to market more expensive, too. But you can try to cut your grocery costs in other ways.

Those hoping to take on home improvement projects this year are also facing supply chain and inflation challenges. There is a long-standing shortage of contractors that could make finding someone to do your work take a while.

The Fed rate hikes may tamper demand later in the year, but this summer is likely to be expensive and competitive for folks who want to take on projects around the house.

To still get some home improvement projects done this year — without busting your budget — you might need to get creative. Instead of doing a complete bathroom overhaul, for example, think about throwing a coat of paint on the walls and swapping out hardware on drawers and cabinets.

Small changes can help you feel like you’re in a new space and can be much more affordable and easier to accomplish than a big project.

Our tips

Don’t count on remodeling getting cheaper: Demand may ease as interest rates rise, but supply chain disruptions and labor issues are likely to persist.

Interview the experts: A contractor, designer or architect may have ideas on how to get the results you want for less.

Consider smaller improvements: If you can’t swing a major remodel right now, smaller fixes, such as new paint or a new countertop, could make a big difference at a fraction of the cost.

More about managing your budget on NerdWallet:

Episode transcript

Sean Pyles: I’ve got a question for all of the homeowners listening. How are your home improvement projects going this year?

If you’re finding them more expensive and slower going than you expected, you’ve definitely got company. And in this episode, we are digging into what’s going on.

Welcome to the NerdWallet Smart Money podcast, where we answer your personal finance questions and help you feel a little smarter about what you do with your money. I’m Sean Pyles.

Liz Weston: And I’m Liz Weston. To send the Nerds your money questions, leave us a voicemail, or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. You can also send your voice memos to [email protected]

Sean Pyles: And follow us wherever you get your podcast to get new episodes delivered to your devices every Monday. And if you like what you hear, please leave us a review and tell a friend.

So, as I mentioned at the top, this episode, Liz and I are talking about how to approach home improvement projects this year, and why they might be a little bit more expensive than you expected.

Liz Weston: I was really looking forward to this conversation, because I have a huge list of projects that need to get done.

So, to help us understand the challenges of taking on home improvement projects right now, and how to get your projects done, on this episode of the podcast, we’re talking with Annie Millerbernd, who’s been writing about this subject.

But before we get into that, Sean and I want to talk about eggs. They’re still incredible and edible, but a dozen today will cost you a ton more than it did a year ago.

Sean Pyles: Yeah. I love eggs as much as the next guy, but why are we talking about them on Smart Money? It’s because the issues that are driving up egg prices show how many seemingly disparate problems can converge to drive up prices on everyday items.

Plus, we want to offer you some tips to help you manage your grocery bill. And also I just love eggs, so we’re going to talk about it.

So let’s start by giving a little bit of context. As a lot of folks know and are experiencing painfully on a day-to-day basis, grocery prices have increased nearly 12% over the last year. It’s the highest jump since 1979.

But inflation is hitting certain food items harder than others. For example, right now the price for eggs is 32% higher than it was a year ago, according to the U.S. Department of Agriculture. And in April, the price for a dozen commercial eggs hit $3 on average, and that’s not including the cost for specialty, pasture-raised or organic eggs.

Liz Weston: Yeah. If you’ve been to the farmer’s market lately, you’ve seen those prices go up as well. It’s basically gotten more expensive.

Sean Pyles: Yeah.

Liz Weston: Why? Why is this happening, Sean?

Sean Pyles: Well, a number of different reasons. As folks can imagine, eggs have been hit by a lot of the same global supply chain issues that other goods have.

But there’s also a very unique issue that’s impacting egg prices right now, and that is an avian flu that folks might have heard about in the news. In December 2021, a new avian flu hit North America, and it is really devastating chickens across the country.

One thing that is kind of good about this is that the risk to humans remains low, according to the CDC [Centers for Disease Control and Prevention]. But chickens, turkeys and other birds are really susceptible.

One thing to note is that avian flus happen pretty regularly, and they’re usually contained quickly. But this one has really not been contained at all.

So, a bunch of chickens have been culled, basically killed, so that they can contain the spread of this avian flu or at least try to. So far this year, over 20 million chickens have been killed to try to contain this outbreak.

Liz Weston: Oh my goodness, that’s a lot.

Sean Pyles: It’s pretty astonishing. Beyond the avian flu, as I mentioned before, there are supply chain issues happening around eggs. The packaging supplies for eggs have gotten more expensive.

There’s also a truck driver shortage. And, as everyone knows, fuel prices have skyrocketed. So, that means that moving eggs from the farms to the grocery store is getting more expensive, and we’re paying for that.

Liz Weston: Yeah, and the eggs tend to have a pretty short life cycle to begin with. So, when the eggs get laid, they need to get moved to the market. It’s not something that you can just set aside or wait on. They go bad.

Sean Pyles: Right. So, this is all to say that there are a number of different things coming together, making egg prices more expensive.

And Liz, how do you think folks can maybe reshuffle their spending habits to make sure that this doesn’t scramble their budget?

Liz Weston: Well, as always with spending, we recommend that you first track what you are spending, so you have some idea of what the outflow is.

And you might even want to figure out what your personal rate of inflation is, because everybody’s rate is a little bit different. If you have a budget tracking device or an app like NerdWallet’s, you can check last year — and see how much you were spending on food, for example — versus this year. Then you have sort of a baseline of what your personal rate of inflation is.

I think the heart of saving money on food is doing some meal planning. And some of us are not in the habit of doing that regularly; other people are. It just depends on how tight money is.

But meal planning is great for a couple of reasons. One is that it lets you take advantage of the specials and the sales that are going on at your local supermarkets. If you’re planning menus around that, you’re going to save money.

Another big benefit of meal planning is that you go to your refrigerator, and you look around your house, and you see what you already have. And that helps you reduce food waste. An awful lot of the food in this country gets thrown away unused.

So, by regularly going through your refrigerator and seeing what’s there and making plans to use it, you can really help cut down on your food costs and food waste in general.

Sean Pyles: Yeah. It also just makes planning your life a lot easier. We have a cookbook that we use that is based around weekly meal planning. So you’ll have four or so recipes per week, and they tend to use similar ingredients. So, if you need parsley for one dish, you’ll use it again in another, a few days later.

And it’ll also have some recipes where it’s based on pantry staples. So, you’ll probably have a box of pasta somewhere in your pantry. You can just pull that out and use it for this dish. So that way, you can make sure that you are using everything that you’re buying at the grocery store.

And you don’t have to scramble each day asking your partner or yourself, “What am I doing for dinner tonight?” You have it set up.

Liz Weston: Yeah. And if you need a little help in getting going with meal planning and food plans, the U.S. Department of Agriculture has monthly food plans that you can use as guidance for grocery spending.

This is interesting, but it’s broken down by four different spending levels. So, thrifty, low-cost, moderate-cost and liberal. I don’t know why they called the most expensive one liberal, but they did. So, for example, the thrifty food plan for a family of four would be about $211 per week.

Sean Pyles: OK.

Liz Weston: So that gives you some idea. The costs go up from there.

Sean Pyles: Interesting. I’m spending about that much with just my partner and I. But I do have a penchant to spend a lot on smoked salmon, because I love my lox bagels in the morning. So maybe that’s one area where I can personally cut my budget.

But, speaking of meat, I know that you’re a big advocate for plant-based diets. And that is a great way to save some money as well, right?

Liz Weston: Yeah. We are not anywhere near totally vegan. We still eat meat; we still eat eggs. But we try to have a couple of plant-based dinners a week, and we will slowly be expanding that.

So, moving away from meat products, animal products, is another way to really help you save money. And it doesn’t just have to be beans and rice.

Sean Pyles: Yeah.

Liz Weston: There’s actually quite a bit of opportunity for really creative meal planning. I just got the book “Cool Beans,” which is a fabulous cookbook of bean recipes.

Sean Pyles: Interesting.

Liz Weston: But again, there’s a lot more products out there now than there used to be.

Sean Pyles: Yeah.

Liz Weston: So, you can experiment a little bit with that.

There’s one other aspect of saving money on eggs that we probably should talk about, and that’s the idea of raising your own chickens, because I know this is something that’s been discussed in your household, right?

Sean Pyles: Yes, Garrett and I have been debating this for a little while. He would love to have some chickens running around the backyard. All I can see is my cat and my dog terrorizing them, and the mess that they’re going to make.

So I’m not so keen on this. And you raised chickens growing up, so I think that you’re kind of in my camp, too. Is that right?

Liz Weston: Exactly. When you said the dog and cat terrorizing the chickens, look for it to go the other way around. We had a terrifying rooster that would fly at your face with those spurs on his legs, just trying to kill you.

So yeah, that and the smell of the manure. Oh my gosh. That’s still in my nostrils all these years later.

So I mean, I know people do this for a lot of reasons. There’s exotic chickens that are kind of fun …

Sean Pyles: Yeah.

Liz Weston: … and all that. But yeah, definitely research it. I think you probably will spend a lot more money on your chicken coops and your chickens.

Sean Pyles: I’m trying to take advantage of the whole backyard chicken thing without putting in any of the work, which is: I will occasionally buy eggs from my neighbors who have chickens, and they are beautiful and delicious.

They come in so many different colors that you’ve never seen before. And I like to get them every so often. But they are about five bucks a dozen, because of all the labor and the materials that have to go into making a dozen eggs from chickens that are in your backyard.

But it’s a nice way to kind of break things up and also connect with your neighbors, at least in my neighborhood.

Liz Weston: Yeah, and if you haven’t had truly fresh eggs, they are a revelation. All this being said, we’ve been talking about how much more expensive eggs are, but they’re still a pretty cheap source of protein.

There’s lots of different ways to save on groceries, and we have a lot of articles on NerdWallet’s site that can help you figure out ways to cut your food budget.

One callout: A lot of folks are struggling with food insecurity right now. So if you are in a position to do so, setting up regular donations to your local food bank is a great way to help people in your community.

Sean Pyles: That’s true. Before we get into our conversation around home improvement season, I have a quick favor to ask our listeners.

We’re always working to improve Smart Money for all of you, so we put together a super short survey. Please take a few seconds to fill that out. You can find a link in the episode description. Thanks in advance.

Liz Weston: OK, now let’s get into our conversation with Annie Millerbernd about home improvement projects this year. Welcome to Smart Money, Annie.

Annie Millerbernd: Happy to be here.

Sean Pyles: Annie, a lot of homeowners — myself included, and Liz, and I’m imagining you — have a pretty long list of things they want to do to their house, but it’s not so easy to accomplish in today’s landscape.

Can you describe the current challenges facing those who want to take on home improvement projects this year?

Annie Millerbernd: The challenges for home-improvers right now come down to supply and demand. And those are two concepts that homeowners and other consumers are very, very familiar with in 2022.

If you want to do a home improvement project this year, resources are limited, and lots of people want them.

Liz Weston: So on the supply side, what’s the situation?

Annie Millerbernd: The supply side actually is two situations. The first is a shortage of labor. So, there’s been a longstanding shortage of construction labor — folks to actually do the home improvement projects — and that issue was exacerbated by the pandemic.

For decades now, there haven’t been enough people to do the home improvement projects. And during the pandemic, you had people being laid off, as they were across many industries. You also had people getting sick and not being able to come to the job sites.

So, that’s made it a lot harder to get a hold of contractors. You’re seeing that show up when you call six, seven, eight contractors, and maybe you only hear back from two or three — and maybe one actually shows up at your door to gives you a quote.

Sean Pyles: Right. We’ve had that experience with my partner’s place in Portland. We’ve had a number of projects that we’ve wanted to get done. And when we have found a contractor who fit the bill for us, we often have had to wait upward of six to eight weeks to schedule a time for them to come out.

And then, even the day of, we’ve had folks cancel, because someone maybe got sick. Or they had another project that was actually more lucrative, and they just wanted to prioritize that instead of ours. So, it’s been quite a time-consuming, and at times, frustrating process to even find laborers.

Annie Millerbernd: Then when you do find a contractor, that person works with subcontractors, and those are also in short supply.

So you get your project started, and then you need someone to come in and do the plumbing. But you need to have that scheduled; that isn’t something that’s just going to happen seamlessly within the process. It’s the same for electrical work and all of the work that you need subcontractors for.

So that makes your timeline, which already took a long time to get started, even longer.

Sean Pyles: Yeah, and you better hope that the subcontractors have all the materials that they need. We put in some new windows in our place in Portland, and that project was delayed a couple times, because the contractors didn’t have the windows. They were just back-ordered for quite a long time.

Annie Millerbernd: Absolutely, and materials are the other side of the supply problem. This is a problem that was brand new during the pandemic. It happened across many different types of goods, where you would order something and you won’t get it for, say, nine months.

We have a coworker who ordered a faucet for her sink. And it is May, and she will not see that faucet until July. And that’s a long time to wait for a faucet.

Sean Pyles: I hope that they like it.

Annie Millerbernd: The materials shortage is kind of an unprecedented thing for the home improvement industry. One economist told me he had never seen all materials in short supply, all at the same time, which was the case during the pandemic. That’s made things a lot more expensive.

So, how that shows up for you as a homeowner is not only are these items more expensive and going to take longer to get to your house, but you may not end up being able to use those shingles that you wanted for your roof, that tile that you planned for your bathroom or that Calacatta countertop that you really wanted. You might have to swap something out.

Liz Weston: But all these problems don’t mean that people are giving up. My understanding is that demand for these projects is still pretty high.

Annie Millerbernd: Yes, demand is way up, and that kicked off toward the end of 2020. There was this narrative of people sitting at home, looking at the same four walls and wanting to change everything about their space.

And we still have a little bit of that. People are still working from home, and people have recently bought a home like myself, and now they want to change everything about that.

So you have that, you have the leftover 2020 projects that people couldn’t get done still being kicked up in 2022. And then you have that kind of pandemic-triggered demand butting up against regular old demand.

Sean Pyles: Well, beyond the leftover 2020 projects, we’ve also had folks that have been spending two-plus years in their house, and so that’s added a lot of wear and tear to things in their house.

I know that our bathroom, for example, the vanity itself is getting a little bit worn down, because we’re just using it so much more, being in the house 24/7.

Annie Millerbernd: Absolutely. And you have, to that end, houses themselves are getting older. The housing stock is aging, and people are having to do more regular maintenance to some of these older houses to keep them in shape.

You also have aging homeowners who want to age more comfortably in their house and make it more accessible, so they’re making modifications there.

There’s natural disaster preparedness, which is another reason people regularly will do home improvement projects. So, that’s kind of merging with the pandemic-triggered demand.

Liz Weston: Some of this was probably fueled by interest rates being low. It was really cheap to borrow. But that’s not true anymore, right?

Annie Millerbernd: No. Now it’s actually going to cost more to borrow money to do these projects. So, if you were planning to use a home equity loan or line of credit, the Fed has raised interest rates.

And there’s some expectation that they’re going to do that a couple more times this year, which means it’s just going to cost more to borrow money to do these projects.

So everything that existed that made it difficult to renovate last year is still there — but now it’s just more expensive to borrow money to do all of those things.

Liz Weston: Well this is depressing, Annie. I got stuff to do — I told you. So is this going to get better, or are we just stuck with this?

Annie Millerbernd: Well, economists don’t expect demand to go down immediately. So, for the home improvement season, as we call it — kind of April to September, October, when people are doing more projects — demand is going to go up. There’s going to be a lot more people this year trying to do home improvement projects.

Toward the end of that season — think late fall, early winter — is when demand will start to slow. It will not go down. Demand will not be less. It will just grow more slowly toward the end of this year.

But that doesn’t mean that the supply issues that we’ve talked about — the labor shortages and the material shortages — will be resolved by then. Nobody really expects that to be resolved this year.

Sean Pyles: So it seems like things are bad and are not going to get better anytime soon. So thank you for painting a very vivid and grim picture of what it’s like to improve your home right now.

But there are things that homeowners can do if they do want to take on a home improvement project this year. It’s not all doom and gloom.

What do you think folks should keep in mind if they’re really dead-set on getting some projects done in 2022?

Annie Millerbernd: My biggest tip for doing a project in 2022 is: If it’s going to make you happy, just do it. If you need that kitchen remodeled to feel better about your home, there really isn’t any sign that waiting a few months or even a year is going to make it any easier or cheaper to do.

If it’s going to make you happy in the short term, then probably you should just take a look at doing it.

Sean Pyles: Take on the project, but maybe don’t go into a ton of debt to do it, right?

Annie Millerbernd: Right, it has to make financial sense for you. So, for example, my partner and I — once we got in the house — were looking at doing a kitchen remodel.

But the cost of that just didn’t make sense for us. We have other stuff we want to do with our money: We’re looking to put it into retirement; we want to explore our new city.

So, it just didn’t make sense for us, in the moment, to do a kitchen remodel and take on that kind of debt that it would cost.

But if, for you, it fits into your budget to do that, then it’s probably worth the time and money.

Sean Pyles: And there are probably some ways to cut costs. Maybe if you had your heart set on one material that is now really expensive or unavailable, you can shop around and find something that is comparable, maybe less expensive. And that’s going to be maybe the best middle ground some folks can hope for.

Annie Millerbernd: Yes. Compromise is the name of the game in 2022. If you wanted a certain countertop, and that countertop’s not going to be available for nine months, maybe pick a plan B.

And a lot of times the contractors will work with you to set your expectations for how long it’ll take to get something, how expensive that item is versus what it was before.

So really find a contractor that you can trust to help walk you through some of those exchanges, if you will, for materials.

Liz Weston: And if you’re interviewing architects, that might be another source. We were amazed at our architect’s suggestions that would save us a lot of money.

For example, we wanted to blow out the back of our house and have huge windows and doors that would slide open. And she just pointed out that putting in windows without panes would do the same thing — open up the backyard — without the immense expense of redoing the whole back of the house.

So things like that can save you some money and maybe get your project done faster. Annie, what else can people do to save a little money?

Annie Millerbernd: Well if it’s something you don’t need — or if you’re like my partner and I, where it’s just not an urgent problem that you’re trying to fix — you can find joy in the little victories.

So our kitchen, when we moved in, was painted black. And there is nothing wrong with the black kitchen. I think a kitchen can be black, and that can be fine. It didn’t work for me. It wasn’t my favorite.

So I just grabbed some paint and painted that kitchen a lighter color. And I like being in it so much more now than I did before. I didn’t need to remodel to feel better about my kitchen.

Liz Weston: How many coats did that take to cover up the black?

Annie Millerbernd: It took two coats of primer and three coats of cream paint. I don’t recommend painting your kitchen black if you’re selling it to someone. It’s just a mean thing to do.

Sean Pyles: Yeah. Well, I’m betting it made the space feel a whole lot smaller. That happens when you paint a smaller room a dark color.

Annie Millerbernd: It did. It made it smaller, and it made everything in it feel like you were in a shadow. It wasn’t a welcoming kitchen.

Sean Pyles: Yeah. I mean, it’s kind of incredible how much a coat of paint can do to transform a room. That’s something that my partner did in our bathroom in Portland, because it was this kind of weird, old stale looking, sky blue paint that just showed every single piece of dirt on it.

And I went away for a trip, and I came back, and he had completely painted the room. And he actually did paint it black, oddly enough. But there was a yellow accent on some counters, and it just pops. And it looks so much more interesting and dynamic, and it totally scratched that itch for us.

Because, similar to what you were describing around maybe you can’t get the right countertop for a kitchen, we couldn’t really get tile or vanities for our bathroom, because they’re just expensive and out of stock. And it wasn’t worth it for us, and we want to do a bigger remodel eventually anyway. So he painted a couple parts of our bathroom, and it feels like a whole new room, basically.

Annie Millerbernd: Yes, it’s such a relief. So, we had popcorn ceilings. We had carpeted floors, and taking that out and putting something else in. So, taking out the popcorn ceiling, putting in nice hardwood floors, has made the space feel different in a good way.

And that’s really what you’re going for a lot of times when you’re doing a home improvement project. You just want to be happier with the space and feel like it says more about you than it does about the previous homeowner.

Sean Pyles: Yes.

Liz Weston: If you’re somebody who’s not happy with little projects, and you really want to go through with the bigger one, we probably should talk about how to pay for it, assuming you don’t have a big pile of cash sitting, ready to go.

Annie Millerbernd: Right. Cash is the interest-free way to pay for a home improvement project. But if you don’t have time to save 30, 40, 50 grand, the best financing option is still going to probably be equity.

Even though there are rising interest rates, your equity is usually the lowest rate option. It has nice long repayment terms if you do a home equity loan or line of credit. And it can get you moving on the project within a month or so.

The other option would be a personal loan, and these are unsecured loans that come in amounts up to $100,000. Underwriting is based on your credit and finances and debt.

So it’s really based on you whether or not you can get this loan and how much you can get for it. The rates are a little bit higher than with equity, but you usually clear the debt a little faster, because repayment terms max out around seven or eight years.

Sean Pyles: Have interest rates on personal loans been rising as the Fed has raised interest rates this year?

Annie Millerbernd: Personal loan rates haven’t risen the same way that equity has. Personal loans aren’t as tied to what the Fed does, since they’re based primarily on your credit profile and income. It’s much more about what you bring to the application than it is to any external factors like the Fed rate.

Sean Pyles: So I would love to hear from each of you what you started out this year wanting to do, and maybe where you are right now, and what you’re hoping to accomplish with your house.

Liz Weston: Annie, you want to go first?

Annie Millerbernd: I started out this year truly thinking I would simply change every room in this house by the end of 2022. I thought this has great bones, and I will just make it a better version of itself, and that’s not …

Sean Pyles: Now might be a good time to say that you are a brand new homeowner.

Annie Millerbernd: Yeah, I really thought it was going to be a snap of my fingers, and everything would be great. That’s not what we’re doing. We’re doing, like I mentioned, the floors, walls and ceilings of the bedrooms.

Also, we’re redoing the entire living room — floors, walls and ceilings. And then we’re going to stop. And we’re just going to enjoy our life in this newer version of our house and see if it makes sense for us to save up for some of those bigger bathroom, kitchen remodel-type projects that I personally would never want to do myself.

Sean Pyles: Right. Well it seems like you still have a pretty ambitious agenda ahead of you. But speaking from my experience: When my partner and I got his place in Portland, we also did ceilings, walls and floors in that order, because we had popcorn ceilings, the walls were all these horrible colors and the floors needed to be totally redone.

And those things alone made the house feel completely transformed, and they were surprisingly inexpensive, mostly because we did all of the labor ourselves.

Liz Weston: Oh, OK. Yeah, that’s another way to save. We talked about that a little bit in passing, but doing this stuff yourself can really save a lot of money.

Sean Pyles: Yeah. Just make sure you watch a lot of videos from This Old House on YouTube. That’s where we learned everything that we know.

Liz Weston: Yes.

Annie Millerbernd: Just Google everything about what you’re doing before you do it.

Sean Pyles: Yeah.

Annie Millerbernd: And if you’re afraid of doing something, do not do it.

Sean Pyles: Don’t mess with electrical or plumbing.

Liz Weston: Yeah.

Sean Pyles: So Liz, what about you?

Liz Weston: Well, we had super ambitious plans. We were going to do a whole house remodel, and we are not at this point. I still think if we wait a bit, we can come up with a better plan and a better deal.

But I do have a 1980s-era kitchen, and I have a 1930s-era bathroom. And the bathroom has kind of a cool blue tub and a blue sink, so it’s that era.

Sean Pyles: Yeah, cool.

Liz Weston: But the tile itself is ugly. Everybody else got this great pink and black or turquoise and black or something like that. We got this weird, peachy colored mess. So at some point I’m going to want to take a sledge hammer to it. It’s just not going to be this year.

Sean Pyles: Well, on my end, so my partner has his place in Portland; I have mine in coastal Washington. My house is brand new. I moved into it last June, and I’m the first owner. It feels kind of incredible. The paint, I think, just stopped smelling like it was fresh, like last week.

But I still have things that I want to do. Namely, I want a fence in my backyard to keep the dog in and to keep all of the deer out, because there are deer everywhere up here.

But I got a quote last year — and again, mind you, this a year ago — it was going to cost me $11,000 for a fence in my backyard.

And that was more than I put down for my down payment and my closing costs combined.

So I didn’t really want to spend all of that money and lose my liquidity.

So I got some simple metal posts and wire fencing and just put that around an area in my backyard. So the dog can hang out, and I don’t have to worry about the deer getting in, whatever.

And even though I’m close to the coast [and] things are getting a little bit rusty from all the salt in the air, I’m hoping, betting, praying that it’s going to last me another year, because I’m not planning on doing anything for my house this year.

Annie Millerbernd: Yeah, it does the job.

Sean Pyles: Yeah, exactly. When you have a dog, you just need to give it something, and it doesn’t have to be extravagant.

Well Annie, do you have any parting thoughts for those who want to take on home improvement projects this year?

Annie Millerbernd: I would just say a home improvement project is supposed to be a good time. It’s supposed to be a good experience.

So even though things might be more stressful and expensive, if you are going to go through with a big remodel, try not to let the scheduling and the pricing overshadow what it is you’re doing, which is really a big accomplishment.

You’re changing your space for the better, and that’s something you should be proud of.

Sean Pyles: Well, thank you for sharing your insights with us.

Annie Millerbernd: Thanks for having me.

Sean Pyles: And with that, let’s get into our takeaway tips. First up, remodeling isn’t getting cheaper. Demand may ease as interest rates rise, but supply chain disruptions and labor issues are likely to persist.

Liz Weston: Next, interview the experts. A contractor, designer or architect may have ideas on how to get the results you want for less.

Sean Pyles: Finally, consider smaller improvements. If you can’t swing a major remodel right now, smaller fixes, such as a new paint job or a new countertop, could make a big difference at a fraction of the cost.

Liz Weston: And that’s all we have for this episode. This week’s episode was produced by Sean Pyles and myself. We also had production and editing help from Anna Helhoski. Our audio was edited by Kaely Monahan, and this week our show notes were edited by Laura McMullen.

Do you have a money question of your own? Turn to the Nerds, and call or text us your questions at 901-730-6373. That’s 901-730-NERD. You can also email us at [email protected]

Sean Pyles: Also, visit nerdwallet.com/podcast for more info on this episode, and remember to follow, rate and review us wherever you’re getting this podcast.

And here is our brief disclaimer, thoughtfully crafted by Nerd Wallet’s legal team: Your questions are answered by knowledgeable and talented finance writers, but we are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes and may not apply to your specific circumstances.

Liz Weston: And with that said, until next time, turn to the Nerds.