Losing your job is stressful enough on its own. Meanwhile, you still need to put food on the table, a roof over your head and manage other financial obligations.

While it may feel like everything is out of your control, there are steps you can take to manage your finances and resources you can use to help keep your head above water.

What to do if you’ve been laid off from work

Step 1: Apply for unemployment benefits

State unemployment offices may be overwhelmed during periods with a dramatic rise in claims. It may take several attempts to file your claim by phone or online, and benefits could be delayed as state agencies try to keep up with demand.

Your state unemployment office’s Facebook and Twitter accounts can also be great resources for updates and guidance.

If your unemployment insurance claim is approved, pay close attention to the benefit details and next steps. Generally, you’ll need to certify that you still meet your state’s eligibility requirements every week or two in order to keep receiving payments.

Step 2: Contact your banks and lenders

“Contact any company you pay regularly and see if they can waive or reduce fees for a while,” says Tara Unverzagt, a financial planner and founder of South Bay Financial Partners in California.

For example, your credit card issuers and utility companies may extend your payment due dates or offer hardship programs. Be proactive and ask for help. Many financial institutions also defer payments on personal loans, auto loans and home loans.

Federal student loan borrowers have some wiggle room. The government has automatically suspended payments on most federal student loans through Aug. 31, 2022. Borrowers will not be charged interest during this time and do not need to do anything to suspend or restart their payments. If you have a private student loan, contact your lender to ask about relief options.

Suspending payments can help free up cash for the things you can’t delay, like food and possibly rent.

Step 3: Triage your finances

Cut out any nonessential spending for the time being. That may mean canceling or suspending gym memberships and subscription services, and even paring down your cable package. You can explore many other ways to live frugally during this period of unemployment.

Remember that these cuts are temporary. The goal here is to free up as much room in your budget as possible for the things that can’t be paused.

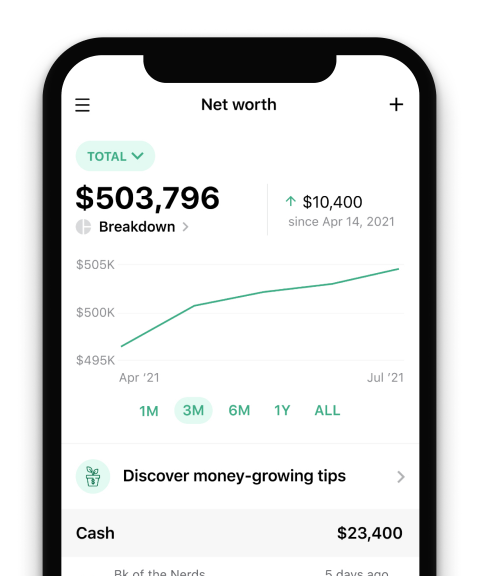

Track your money with NerdWallet

Skip the bank apps and see all your accounts in one place.

Step 4: Tap into community resources

Communities offer an abundance of resources for those who’ve fallen on hard times. Now is the time to take advantage of those resources.

For instance, individuals or families in need of food can call the USDA’s National Hunger Hotline (866-3-HUNGRY) to find emergency food assistance in their area, such as community kitchens and food pantries. For a comprehensive list of social services and other sources of help, visit 211.org or call 211 from any phone.

You can also use online platforms like Nextdoor and Craigslist to search locally for free items such as clothing, furniture and books.

Step 5: Be strategic with your money

If you find yourself unable to cover all your expenses, be aware of how to pay bills strategically to limit damage to your finances.

Tap your emergency fund if you have one — that’s what it’s for — and you may need to relax your rules about using credit cards. You can work on rebuilding your emergency fund and paying down debt after you find your next job.

Step 6: Explore ways to make or borrow money

You may need extra funds to help cover the gap between the time you’re laid off and when unemployment checks come in or you return to work. If you’re looking to get cash fast, there are several options to consider.

For example, you can try selling things online, pet sitting or picking up another side gig to make money. You can also seek loans from family or friends, banks, credit unions and other lenders. Make sure you understand the terms and only borrow what you can afford to repay. Learn more about different hardship loan options and which ones to avoid.

Step 7: Examine your health care options

Health insurance coverage through your employer often continues until the end of the month, or longer, after a layoff. But that may not bridge the gap until your next gig.

Job loss is considered a “qualifying life event,” meaning you can get health insurance outside of the annual open enrollment period. Explore these options:

-

Your parents’ plan, if you’re under age 26.

-

Your spouse’s employer-sponsored plan.

-

The health insurance marketplace (Healthcare.gov). The website also can help you understand if you and your family qualify for Medicaid or the Children’s Health Insurance Program.