The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a discussion about how to prepare your finances for a recession.

Then we pivot to a lightning round of money questions.

Check out this episode on any of these platforms:

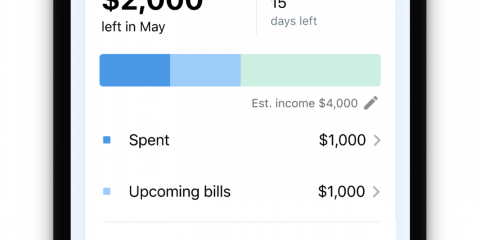

Before you build a budget

Track all your spending at a glance to understand your trends and spot opportunities to save money.

Our take

A recession might be inevitable — but that doesn’t mean we’re about to slip into one right now. Either way, it doesn’t hurt to prepare your finances for the worst. That means focusing on saving money and trying to trim expenses where you can. In light of inflation, think about taking advantage of coupons and shopping at wholesale stores to save money. Also, try to take the long view when it comes to investing. Selling when stock prices drop can mean that you lock in losses.

If you’re looking to become a home buyer, understand the current challenges. While the market might be cooling off a little, rising mortgage rates can make affording a house more challenging. Over the life of a loan, a higher mortgage interest rate can result in you paying tens of thousands of dollars more for your house. Also, set yourself up for success by building your credit before homebuying. The best rates tend to go to those with credit scores north of 740.

For those in the market for a car, the good news is that vehicle prices aren’t increasing at the rates they did over the past year. But cars are still more expensive than they were two years ago. As a result, trading in your current car and trying to buy a cheap used car might mean downgrading your vehicle. And if you’re shopping for car insurance, know that Consumer Reports recommends dropping collision and comprehensive coverage when the annual premium is equal to or greater than 10% of your car’s cash value.

Our tips

Know how mortgage interest rates impact home affordability: An increase of even 2% can mean paying hundreds of dollars more in interest monthly.

Understand car insurance: A decision about whether you should have collision insurance can come down to the cash value of your vehicle.

Save smart: High-yield savings accounts can be good places to park emergency funds, but investing is your best bet to stay ahead of inflation.

More about managing money on NerdWallet:

Episode transcript

Liz Weston: Are we teetering on the brink of a recession, or are folks just getting ahead of themselves? Either way, it doesn’t hurt to prepare for the worst.

Sean Pyles: Welcome to the NerdWallet Smart Money podcast, where we answer your personal finance questions and help you feel a little smarter about what you do with your money. I’m Sean Pyles.

Liz Weston: And I’m Liz Weston. To send the Nerds your money questions, leave us a voicemail or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. You can also send your voice memos to [email protected]

Sean Pyles: And follow us wherever you get your podcast to get new episodes delivered to your devices every Monday. And if you like what you hear, please leave us a review and tell a friend.

Liz Weston: One of the best parts about our jobs is helping people find answers to their money questions. But your questions have been piling up. So this episode, Sean and I are doing another lightning round where we answer as many of your concerns as we can.

Sean Pyles: That is right. And listen to the end to hear our takes on the best ways to grow your money. But before we get into that, Liz and I are digging into how to prepare for a recession, whether one is coming or not.

Liz Weston: Well, I think we can always say a recession’s going to come at some point, but the question…

Sean Pyles: Whether it’s imminent or not.

Liz Weston: Yes. Yes. That’s the big difference. And this puts a little pressure behind this discussion is, are we going to be facing this sooner or later?

Sean Pyles: Right. I think a lot of folks are concerned about it right now because inflation is sky high. We have the conflict in Ukraine that is making things worse. We have officially entered a bear market, which means that the stock market has dropped 20% from a recent high. And folks are feeling nervous right now.

Liz Weston: Maybe we can talk first about what a recession is because that’s a term that gets thrown around a lot. And people don’t understand that it actually means when the economy goes into reverse and economic growth stops.

Sean Pyles: Yeah. And the economy begins to shrink. But it’s important to note that they can vary greatly in severity. Not every recession is going to be like the 2007 to 2009 Great Recession. Some are just a few months. And then we reverse course and things begin to improve again.

Liz Weston: Whether you’re going to feel a recession or not really depends on how bad it gets and what’s happening in your region. I live in California, which is often recession-proof. It’s kind of amazing how often the local economy does not go into the dumps when the national economy does.

Sean Pyles: Right. But on the other end of the spectrum, there are some industries that tend to feel it really quickly. Like my partner is an architect, and when recessions happen, architecture is one of those industries — at least in commercial development where he works — that tends to slow down pretty quickly. And so there usually are a number of layoffs and that can be a leading indicator that we are in a recession or heading into one, whether architecture jobs are beginning to get cut.

Liz Weston: And you can’t really make your finances recession-proof. I see headlines like that all the time. And that’s not really possible, but what you can do is to try to make your finances a little bit more resilient.

Sean Pyles: One thing that you can control is your spending. So we know that if you lose your job in a recession, it can be really difficult to cover all of your bills. So if that does happen, what we typically recommend is that people pay their bills strategically. That means focusing on things like housing and food and utilities. And maybe try to negotiate things like your cell phone bill, and maybe cutting back on cable or subscriptions to minimize those more discretionary bills that you might have.

Liz Weston: We saw during the pandemic the recession was actually very short-lived, but the lenders were really responsive. There were a lot of programs for forbearance, for being able to skip payments for a while. So generally the advice is contact your lenders if you can’t afford to pay a bill. If you can afford to pay the minimum, great, just keep doing that. But if you’re really struggling, reach out to your lenders and see what programs they’ve got.

Sean Pyles: As we all know, and as we talked about last week in our conversation with Darian Woods, from “The Indicator from Planet Money,” inflation is wreaking havoc on everyone’s budgets right now. So to the extent that you can, try to minimize costs. I’ve been going headfirst into couponing, which is something that we should maybe talk more about in upcoming episodes. I’m really digging into the coupons, scrolling through websites. I’ve also been shopping more at wholesale stores and using GasBuddy.

Sean Pyles: There’s actually a product through GasBuddy where if you sign up for it and you link your bank account to it or credit card, it can help you save a couple cents per gallon potentially, depending on the gas station. And every little bit adds up. And that’s the approach that I’m taking. I’m also trying to drive less. So I’m going to meet up with friends for dinner or just to go shopping on the weekend, I’ll bike to meet up with them. Whereas typically if I’m feeling lazy, I would just want to drive. And it’s a beautiful time of year right now. Just get out, bike a little bit, walk a little bit, save the gas.

Liz Weston: And here at NerdWallet, we have a whole list of credit cards you can use to buy gas with that give you rebates, that can help with those costs.

I was just at Costco this weekend and I was amazed at the line to get to the pumps. Seriously, there were hundreds of cars in line and I had to wonder how much gas are you spending, waiting in line to get to the pumps? For some people, this is crisis level. I mean, they really need to drive. They really need gas, and it’s incredibly expensive. So everything you can do to cut back elsewhere to make this possible is really helpful, I think.

Sean Pyles: Another way that we recommend folks shore up their finances ahead of a potential recession is to really focus on savings. And you don’t have to have three to six months saved up today. It’s important to start where you are right now and grow savings gradually. Studies have shown that savings of $500 can help you weather a number of financial shocks, like you need to get a new tire on your car or your water heater breaks down.

Liz Weston: Yeah. People think that emergency funds or their emergency funds are a failure if they have to drain them. They’ll try to save some money, and then a crisis will happen and they have to suck out the money to pay for something. It’s exactly what an emergency fund is for. It’s to keep you from going into debt. So anything you could set aside can be really helpful down the road.

Sean Pyles: One thing that has actually been a silver lining of the interest rates going up lately is that high-yield savings accounts are finally earning you a little more than they have been over the past few years where they really weren’t high yield at all. So I’ve been enjoying seeing a couple dollars come into my accounts every month, but it does take time to build up the savings to actually take advantage of the higher interest rates on a high-yield account. So the best approach is slow and steady and appreciate the progress that you’re making one paycheck at a time.

Liz Weston: Well, and the market’s latest shenanigans really brings home the point that you do not want to have money that you’re going to need in the near future sitting in investments of any kind, whether it’s stocks, whether it’s crypto, whatever. Your emergency fund — the money that you could need within the next year or two — really needs to be sitting somewhere safe, FDIC-insured, protected. You want it waiting there for you. So a high-yield savings account is a great idea. It gives you a little bit more savings, but it’s still protected.

Sean Pyles: Right. It keeps your cash fairly liquid. But what I really like is having a separate account for my savings versus what I have my regular checking in, because that way there is two to three days delay from transferring. So I’m less likely to pull from my savings if I need to. I really do use it just in case of an emergency.

Liz Weston: But it’s really interesting that just having that little bit of distance is enough to slow you down from impulse spending.

Sean Pyles: Right. I mean, personal finance is 50% psychological tricks, and that’s one that I rely on all the time. But you mentioned investing a little bit ago and that’s something that we should touch on as well. So typical caveat, we are not financial or investment advisors. We will not tell you what to do with your money, but we’ll give you some context for how to think about your own decision-making with it.

But when it comes to investing and recessions, some folks can get a little bit spooked and want to pull all of their money out, especially with the way the stock market has been lately. But here’s the thing, when you sell as stock prices drop, you can be locking in losses. Whereas, if you’re invested for the long term, again, having money that you don’t need within five years in a well diversified portfolio, know that you’re doing what many financial advisors would recommend you do in difficult times.

Liz Weston: Yes. And selling when stocks go down or selling before stocks go down, may seem like a smart move, but the problem is stocks will move up again very quickly. And you will miss that. If you’re out of the market, you’re going to be basically selling low and buying high. That’s exactly the opposite of what you want to do. So, take a deep breath and try to ride it out.

Sean Pyles: And maybe avoid looking at your retirement accounts for a little while. I checked on mine, I’m going to say two weeks ago, and I gasped a little bit. I’m going to admit that, but I figured OK, this is one moment in time. I’m not retiring tomorrow. Let me close this window on my browser and go about my day because there’s nothing I can do about this right now. So I just rode it out and I’m continuing to do so.

Liz Weston: Yeah. And what happens day-to-day doesn’t make any difference in your life. It’s what’s happening over time. And if you go back and look at what the stock market was doing 30 years ago and where it is today, that’s solid gains.

Sean Pyles: Exactly. Well, I think that about covers it for now. Before we get into our lightning round, I have a quick favor to ask of our listeners. We’re always working to improve the show for all of you and we want to gather some feedback. So I put together a super short two-question survey. Please take a few seconds to fill that out. You can find a link to it in our episode description. Thank you in advance for that, we really appreciate it. And with that, let’s get into our first question from the lightning round.

Liz Weston: All right.

Sean Pyles: OK. And the first question comes from a listener’s voicemail. Let’s hear it.

Listener 1: Hi, my name’s Katie. I’m one of those poor people that’s trying to buy a house right now because I have terrible timing in life. But my question is, how much does raising of interest rates actually make a difference in terms of a home mortgage? Like when the Fed raises the interest rate by 0.25%, what does that actually mean in terms of how much money I’m paying to borrow money in a 30-year mortgage? I really don’t understand how that plays out. So, if you could help me understand, that would be great. Thanks. Bye.

Liz Weston: I’m going to dust off my old economics degree for this particular answer. The Fed does not directly set mortgage rates. Instead, our central bank tries to influence rates throughout the economy by changing something called the federal funds rate. What that is basically is the overnight rate that banks can charge each other for borrowing money.

Sean Pyles: And mortgage rates are typically based on a much longer rate, the one for 10-year Treasury bills. But mortgage rates are also influenced by supply and demand. If there’s a crush of borrowers, rates can go up. Another factor is investment demand. If lenders are trying to attract the investors who buy mortgages, they might raise interest rates.

Liz Weston: Fed moves do tend to have a ripple effect throughout the economy. So if most rates are going up, mortgage rates are probably going to be going up too.

Sean Pyles: Right. That’s why it’s really easy to conflate these different rates in how they move, even though they’re separate.

So now let’s dig into the cost difference of an increased interest rate to directly take on our listener’s question. Because a Fed interest rate hike of 0.25% or 0.5%, doesn’t translate to mortgage interest rates being 0.25% or 0.5% higher. But mortgage interest rates have really been on a tear lately. They were around 3% at the beginning of this year. And in early May, they were over 5%.

Using NerdWallet’s mortgage calculator, I found the difference between an interest rate of 3% and 5% on a $300,000 mortgage is about $340 a month. So paying 2% more in interest translates to roughly $340 more a month for your housing payment. That would add up to over $4,000 a year or over $123,000 over 30 years.

Liz Weston: Ouch. That’s a lot.

Sean Pyles: It really is. And that’s all to say that interest rates can make a big difference in affordability too.

Liz Weston: Definitely. Well, here’s another question related to home buying. And this comes from a listener’s email. They write, “I want to buy a house, but I’m not sure what my credit score is yet. Should I check my credit score from each of the credit bureaus? I was also thinking about getting a credit card, just to help my credit scores go higher. I’ve never had a credit card ever, and I’m 38 years old. So my questions are, should I get a credit card? And what type? How many times can we check credit before it dings it and lowers it?”

Sean Pyles: It is incredible to me that we still get this question around how many times you can check your credit score before it is lowered? And the answer is as many times as you want, it’s never going to get lowered.

Liz Weston: This is an incredibly persistent myth, and we have to say it right out, checking your credit doesn’t hurt your credit scores. But it’s a huge myth. And it’s been incredibly hard to kill.

Sean Pyles: Yeah. Well, let’s talk about ways to check your credit scores because it seems like at this point, there is almost an infinite number of websites — NerdWallet included — where you can get your credit score for free. And they often update weekly, which is a pretty handy way to monitor changes in your score because you’ll see fluctuations from one week to the next based on things like how much credit you’re using.

Liz Weston: Exactly. And we should clarify that credit scores are different from credit reports. So your credit reports are these files that are kept at the three big credit bureaus, Equifax, Experian and TransUnion. And it’s the data in those reports that go into creating your scores. So you have the right to check your credit reports every week right now. And that’s going to last through the end of the year. You want to go to annualcreditreport.com to request your reports from all three credit bureaus.

If you want your scores, which are the three-digit numbers that lenders use to gauge your creditworthiness, you can get them for free here at NerdWallet. You can get one of your TransUnion scores here. Or you can buy them from various sources. You can check if you have a credit card or a bank account, they might offer you credit scores as well. So there’s a lot of different ways to get credit scores.

Sean Pyles: It’s worth noting that there are actually a number of different credit scores. There’s not a single one that you have. So if you apply for an auto loan, that’s one type of credit score that’s being used to determine your creditworthiness. And another may be used for applying for a credit card, for example.

Liz Weston: Yeah, exactly. You may have heard of FICO scores. That is the most used formula, but it can be tweaked for different industries like auto loans or bank credit cards. And then there’s the VantageScore which is the kind that NerdWallet offers that was built as a competitor to the FICO score. So this gets a little confusing sometime. But basically following one of your credit scores can help you see the changes in your underlying credit reports, and see what’s helping and what’s hurting.

Liz Weston: But in answer to the reader’s question, yeah having a credit card can help your credit. The credit scoring formulas generally like to see you have and regularly use different types of credit.

Sean Pyles: Right. And I think that knowing your score is a good first step. And next is to know your goal. Our listener wants to become a homeowner. And so it’s worth knowing that the best mortgage rates typically go to those with credit scores north of 740.

So if someone has never taken out a credit card before, their credit profile is probably pretty slim. It might be a good idea for them to look into secured credit cards where they basically pay a deposit of a few hundred dollars typically, which often works as their credit limit for the card. You get the deposit back when you upgrade to a regular unsecured card or close the account and get standing.

Liz Weston: Yeah. And there are also credit-builder loans. We’re a real fan of those here at NerdWallet. The amount you borrow is held in a bank account while you make the payments. Once you’ve fully paid off the loan, you get that cash back. So you’re able to build savings and your credit at the same time.

And then there’s becoming an authorized user of a credit card. That’s another way that you can really jumpstart your credit. Essentially, you ask somebody with good credit to be added as an authorized user to their card. And their history with that card is imported typically to your credit reports and can help your scores.

Sean Pyles: That’s a great shortcut to boost your credit profile. And for our listener who is 38 years old and is really taking getting their credit built up seriously now, that could be a great way for them to do it without having to wait years and years.

Liz Weston: Yeah, exactly.

Sean Pyles: All right. And now let’s move on to our next listener question. One of our listeners applied for a credit card recently, but instead of getting approved instantly, they got a message that their application was, dun, dun, dun, pending. So what do you do in that case? They wrote, “For reference, I have excellent credit and in the past have almost always been approved instantly. I have the NerdWallet app and don’t see any delinquency or anything that could put a hold on my application. Any suggestions for best practices in this situation?”

Liz Weston: I don’t know about you Sean, but this has happened to me and more than once. And if you’re used to being approved instantly, it can be a little alarming. But there’s a lot of things that could be happening here. There could be some mismatch between the information you put in the application and in your credit report. Or you could have had a bunch of applications recently. Or there could be some concern about identity theft, identity fraud. The lender wants to verify some details, verify your income, or possibly they’re just overwhelmed with applications. That happens, a super popular card can cause problems at the other end, where the issuer is trying to process all these applications.

So if you are turned down, ultimately you will get a letter in the mail saying why. I would say pick up the phone and call and ask for a reconsideration. If you have good credit, or if you’re an existing customer, those could be reasons to accommodate you.

Sean Pyles: I had an experience one time where I applied for a popular travel credit card and I had to wait upward of a week to hear back, which I was pretty surprised by. My ego took a little bit of a bruise because I thought I have stellar credit, what’s going on here?

Yeah, but you’re right, there could be something more serious going on. And in my case, the issue was that I had forgotten to unfreeze one of my credit profiles from the credit bureaus. And I keep all of my credit profiles frozen to avoid fraud or do the best that I can to avoid fraud. And I simply forgot to unfreeze one of them. So that’s something to keep in mind as well.

Liz Weston: Well, credit cards seem to be a popular topic lately. Here’s another question from a listener’s voicemail.

Listener 4: Hi Nerds. I was just listening to your podcast on authorized users for credit cards and had a question about benefits for authorized users — and when that authorized user wants to open their own card. So my question is, if I was an authorized user on a card that has benefits like miles say, could I now open my own credit card with that company, same brand, and receive the bonus benefits for signing up? Thanks so much. Bye.

Sean Pyles: All right, sign-up bonuses are a big deal. Sometimes most of the points that you’ll get from a card come from that sign-up bonus. It’s often your fastest way to get points on a credit card. And lots of issuers do have restrictions that prevent current cardholders from getting a bonus. But being an authorized user is not the same as being a cardholder in many important ways, and that includes qualifying for a bonus. And you should still be eligible to apply for that card to get the bonus on your own.

Liz Weston: OK. That is good news. So one more credit card question. And this also comes from a listener’s email. “I opened a travel credit card about six months ago in anticipation of moving and expecting more travel on a regular basis. When I opened the card, my score dropped since my average age of credit went down. My priorities have changed a lot since then. And I’m more concerned with getting my money in shape and increasing my credit scores. If I close that account now, won’t my average age come up, and potentially increase my score?”

“I know closing an account could damage my score in the short term, but the limit on the card is only $700. And I have a few other lines of credit with limits between $2,000 and $5,000. Should I close the card to bring my average age of credit up? In other words, make it older. Or keep the card open to have more credit available?”

Love the fact that our listener wants to get their money in shape, but closing accounts cannot help your credit scores and may hurt them. This doesn’t mean you should never close a card, but you definitely shouldn’t do it if your goal is to improve your credit.

Sean Pyles: Yeah. Closing the account will not erase the effects of opening it. The average age of your account is much less important than your payment history and your credit utilization, which is the amount of your available credit that you’re using. Closing accounts takes away a portion of your available credit and is not good for your scores.

I do have one idea for our listener though, if that travel credit card they opened has an annual fee, and they’re not really utilizing the benefits of the card, they might want to look into what’s called a product change, where they can transfer their current card to a different card from the same bank. They’ll retain the same credit history and potentially the same credit limit, but they could move to a new card that doesn’t have an annual fee, and that could potentially ease some of their problems as well.

Liz Weston: Oh, that’s a good suggestion.

Sean Pyles: All right. And now we have a question about cars, another hot topic from a lot of our listeners. And it comes from their voicemail. Here it is.

Listener 6: Hey, my name is Alejandro. I’m 22 years old. I’ve been thinking about selling my car. I bought it two years ago. It’s the 2019 Honda Accord. I actually bought it when I had no idea about personal finance. I got a horrible interest rate at 12% and I got a bunch of unnecessary stuff with it.

Ever since I realized how bad of a financial decision I made, I really devoted myself to paying the loan off and I’m actually almost done paying it off. I actually want to sell it because of opportunity costs and downgrade to a $5,000 used Honda or Toyota. Since I want that money to do better for me in an asset rather than in a liability. I’d like to hear any thoughts. Thank you so much.

Liz Weston: Oh, somebody else who wants to get better with money, that is so good. But now is a terrible time to buy any car if you can avoid it. And I think our listener may be giving up a good car with hundreds of thousands of miles left in it, and taking a gamble on an unknown — a $5,000 car. They have no idea what the history has been. What do you think Sean?

Sean Pyles: I think $5,000 for a car is not going to get you a lot right now. I generally agree with you, Liz. I think while the listener probably feels some resentment about the car loan that they got and the money they paid in interest — because 12% is high for a car loan — I think they have made some smart moves by paying it off quickly. That ensures that they’re limiting the amount of interest that they are paying, given the circumstances.

And one note about our listener wanting their money to go into something that is an asset rather than a liability. Traditionally, all cars pretty much have been liabilities because of how quickly they depreciate, but that isn’t the case right now. Chances are that the listener has actually accrued some equity in their car since they bought it in 2019. I bought my car in May of 2020. And I’m seeing similar cars that are selling for $5,000 to $8,000 more. That’s just the way the market is right now. And additionally, I also know the pain of buying stuff for your car that you don’t need. When I bought my car a couple years ago, I let myself get talked into a warranty that I totally did not need. But the best you can do sometimes is learn from that experience and not get suckered into unnecessary add-ons in the future.

Liz Weston: Our autos Nerd Phil Reed also told us you can cancel those warranties too, if you no longer need it.

Sean Pyles: Oh, that’s good to know. And this also might be a good opportunity to throw out the benefits of looking for auto loans through credit unions. They tend to have some of the most competitive rates for auto loans. So as I’ve mentioned before on this podcast, I am a huge advocate of credit unions. The best time to join one is today, if you haven’t already joined one. And that will make it so that next time you’re in the market for an auto loan, you can easily apply with that credit union and shop around and get the best rate.

Liz Weston: And Phil Reed also created a car buying cheat sheet that is absolutely golden. And we will link to that in the show notes.

Sean Pyles: Yes we will. OK. And our next car question is from Nancy in Texas, who writes, “My husband and I try to keep our cars for 10 years each, replacing one every five years. What we are never sure of is when or ever to change our insurance on a car to a liability-only policy? We always buy new. Is there a number of years to consider? A number of miles? Blue book values? Does the car brand matter?”

Consumer Reports recommends dropping collision and comprehensive when the annual premium equals or exceeds 10% of your car’s cash value. You can find a general estimate of your car’s value online, but the somewhat unfortunate news is that this will require you to do a little bit of math.

Liz Weston: Yes. And in addition, if you drop this coverage on your car, you won’t have it when you go to rent a car, typically. So certain credit cards may offer that rental insurance that can step in as primary when you don’t have such coverage through your auto insurance policy. But you want to find out. An internet search can tell you if your credit card offers this particular insurance, but call the number on the back of the card to confirm what’s covered. Because if you don’t have the coverage, you’ll definitely want to pay for it when you get to the rental car counter.

Sean Pyles: Yeah. Well, one thing that comes to mind for me is that I am maybe a little bit of a paranoid driver. And even if I do hit that point where my annual premium exceeds or equals 10% of my car’s cash value, I would maybe be inclined to keep comprehensive, just so I have that extra coverage in case the worst happens. How do you think about this with your cars, Liz?

Liz Weston: Well, the problem is you get less and less as the car gets older. So you have to ask yourself if paying those monthly premiums or annual premiums is going to be worth what you get out? So possibly, I mean, this is kind of a different line for everybody to draw, but if money is tight or you don’t have the cash to come up with a down payment, and even the smaller amount that’s provided by your policy would help you out, then maybe you keep the coverage.

Sean Pyles: All right, let’s move on to our next listener question, which is a voicemail about saving for college. Here it is.

Listener 8: “Hey guys, name’s Phil H. Love the podcast. I had some questions around the 529 accounts for kids, since we’re just starting a family, when’s the best time to start it? I figure it’s as soon as they’re born. How much to put in? I understand it’s for educational purposes, but what if they get a full ride? What if they don’t get a full ride, or partial ride? What does it go to? Just a lot of questions around that, and how it can help them in the future? And of course, taxes around it as well. Thank you so much.”

Sean Pyles: Anything you save will help your kids avoid loans in the future. College is likely to be pretty expensive and full rides are pretty rare, unfortunately. Less than 2% of high school athletes get a full-ride offer. Even if your kid does get an offer, they might not choose that school. And in the off chance you don’t need all the money you save in a 529, you can transfer the balance to another child or even use it yourself. And if you don’t use it all, the worst that can happen is that you’ll have to pay income taxes on the gains, plus a 10% federal penalty.

Liz Weston: People get really freaked out at the idea that this money is going into a 529, and it might not be used for college. But really 529s are super flexible. They protect the gains that you’re making from taxes. The money can grow tax deferred over time and it’s tax-free when you pull it out for college. So those are all huge, huge benefits. I’m a super big fan of 529 plans for kids in case you can’t tell.

And you can also use them for private elementary and high school expenses now as well. So I think it’s worth taking the risk of putting the money in. I’m pretty sure the kid’s going to use it.

Sean Pyles: Yeah. They can also be a nice way for grandparents and other relatives to contribute to college plans as well, right?

Liz Weston: Very good point. Ask them to maybe chip in instead of buying them another piece of plastic for Christmas, or for other holidays.

Sean Pyles: Well, here is our last question from a text message. Here it is. “What is the best safe way to grow your money? Like a high-yield savings account?” Well, the tricky thing is that safety and growth are pretty much mutually exclusive when it comes to growing money.

Liz Weston: If you really want to grow your money, you’ve got to take some risk.

Sean Pyles: Yeah. But if you want to squeeze a little extra return without putting your money at risk, then a high-yield savings account is often the way to go. NerdWallet has some recommendations about where you can get the best rates right now. But it’s also worth saying that because we are in a time of high inflation, investing is often the only way to stay ahead of that inflation.

Liz Weston: There’s no asset class. There’s no type of investment that does better at beating inflation over time than a diversified portfolio of stocks. If you’re interested about maybe eking out a little bit more return, you can take a look at I bonds or treasury inflation protected securities. They’re a little more complicated than we have time to go into now, but that’s a way to possibly make a little extra money while still keeping your principal safe.

Sean Pyles: And that is all we have for this episode. Now, if you want the Nerds to answer your money questions, call or text us on the Nerd hotline at 901-730- 6373. That’s 901-730-NERD. You can also email us at [email protected] And visit nerdwallet.com/podcast for more info on this episode. And remember to follow, rate and review us wherever you’re getting this podcast.

This week’s episode was produced by Liz Weston and myself. Our audio was edited by Kayleigh Monahan and we had editing help this week from Courtney Neidel.

Liz Weston: And here’s our brief disclaimer, thoughtfully crafted by NerdWallet’s legal team. Your questions are answered by knowledgeable and talented finance writers, but we are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes, and may not apply to your specific circumstances.

Sean Pyles: And with that said, until next time, turn to the Nerds.